During the early weeks of the outbreak, the response from financial markets was somewhat muted. However, as the virus has continued to spread, markets have reacted in a more pronounced way to the impact on supply chains, tourism, and global demand. As Covid-19 continues to become more widespread, the impact is increasing and will undoubtedly last for longer than initially expected.

While the initial effects for more traditional asset classes were relatively quick and clear cut, for private markets, and particularly those like microfinance that we invest in, the implications of Covid-19 are more nuanced and vary by region, industry and business model.

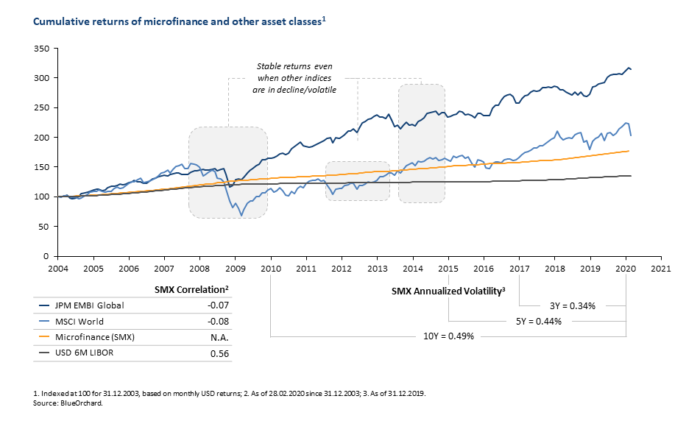

Microfinance is historically less correlated with public markets – one of the notable benefits of investing in the asset class is the diversification that it can bring to an investor’s portfolio. Microfinance investments, particularly in emerging and frontier markets, have historically been quite resilient to shocks of this nature, particularly if you look at SARS in 2002, the global financial crisis in 2008 and MERS in 2012.

Emerging and frontier markets are proving to be extremely responsive to the Covid-19 crisis. Many of them have been highly proactive in closing schools, borders, and putting in place lockdown measures with the aim of protecting their population. Some are also taking measures to support their economies through monetary and fiscal measures. One of these is to allow a ‘credit holiday’ for a limited period of time (usually three months) for borrowers facing difficulties meeting payments as a result of Covid-19 related business disruptions. While some financial institutions can handle this with ease, others might face some liquidity pressures. We are in constant contact with investees to identify any potential liquidity issues as early as possible, with the aim of proactively addressing it.

So far, we have not identified any significant impacts to the businesses that we invest in, but we continue to pay close attention as the situation evolves and allocate investments in our portfolios accordingly. We have taken steps to reduce the investment level in our microfinance portfolios and further focus on quality names and defensive positioning in our impact bond portfolios. As a company, we have restricted travel and participation in events and adopted a remote working arrangement for all of our employees globally.

While it is too soon to quantify fully the impact of the virus on our investments, there are some areas that we anticipate will be more significantly affected. A slowdown in Chinese growth could have knock-on effects for markets that are heavily reliant on China for trade, investment and tourism.

To date, most countries that we invest in have only reported a few cases of Covid-19, although it is difficult to anticipate what the ultimate spread will look like. When combined with a sharp reduction in international travel caused by the virus, it is possible that the spread in the developing world could remain relatively low, with exposure for investees focused in rural areas with low population density even lower.

The policy response in individual countries has and will continue to differ significantly. In some countries we have seen strong containment efforts, combined with various measures to support businesses and individuals, including fiscal stimulus and coordinated action with the financial sector. The World Bank has also pledge USD 14 billion to support developing countries in coping with the public health issues and knock-on economic effects posed by Covid-19, with additional initiatives anticipated as the situation develops further.

It is important to highlight the role of the international development community in providing liquidity to the developing world. In the global financial crisis of 2008, coordinated action in the development community in inclusive finance helped significantly to provide needed liquidity to support the ongoing operations of local institutions in the face of reduced global risk appetite. Because of this, alongside continued funding from commercial funders like BlueOrchard, well-performing microfinance institutions were able to continue to serve their clients.

Our local investment teams around the world are maintaining open communication with investees as well as local authorities and regulators in order to assess the impact of the virus. We expect the uncertainty around the economic impact of Covid-19 to continue and are structuring our portfolios accordingly. The BlueOrchard Risk Committee has requested regular updates and will meet more frequently in the coming weeks and months to review and adjust our strategy as circumstances demand.

As an impact investor, we believe that it may be during times of crisis that micro entrepreneurs have the greatest need for access to capital and other services to support income generating activities. Access to these services unleashes the potential of individuals who may be socially and economically vulnerable, and can help to break the cycle of poverty and oppression, empowering individuals, families and wider communities.

Originally published on 17 March 2020, updated on 31 March 2020.