This is not news in the world of impact measurement and monitoring where all gets down to materiality of data, replicability of results, and critical importance of local context. A mix of quantitative and qualitative indicators is often what is required in assessing local needs and regional specificities especially when we aim at using data to inform future investment decisions.

Whilst climate change is considered a global issue, its impacts are felt by local people and ecosystems. To truly understand the level of impact, access to local data is key to prepare the selected communities, economic activities and sectors for the level of adaptation required and the extent to which climate-related impacts are already being felt.

COP27 marked a historic agreement to establish and operationalise a loss and damage fund to assist developing countries, who are particularly vulnerable to the effects of climate change, with the costs associated losses from extreme weather events. Over the same week, the V20 and G7 launched the Global Shield Initiative, a financing facility to provide pre-arranged finance to distribute before disasters happen – providing protection to vulnerable nations to lessen the impact of disasters and build resiliency. Both these new initiatives have a major similarity; they are linked to changing and exacerbated weather conditions.

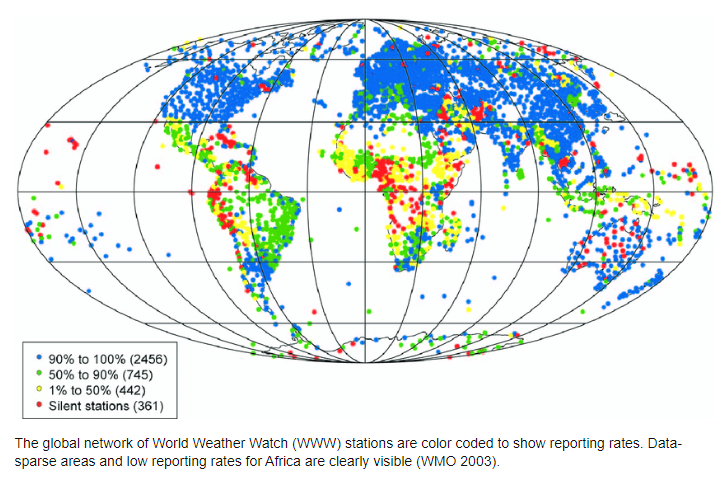

This marks a great step forward in climate justice, but concerns remain that a lack of weather data across Africa could inhibit nation’s ability to apply for loss and damage funding.(1) This inability comes from a lack of weather monitoring stations to prove that a certain disaster was caused by climate change; and could dramatically affect the distribution of loss and damage funding if became a compensation requirement.

To assess current and forecast future weather-related events in a specific area two components are required: the number of observations recorded within a region to make a finding valid and the period over which these are recorded. This is why weather stations have a key role to play in recording weather conditions. Tracking whether a change of weather conditions has occurred over time, is central to the definition of a sustained climatic change. A final addition is the timeliness in which data is transmitted to central stations; whilst not integral to the assessment, it limits the ability for early warning signals and loss and damage consequences being potentially reduced.

Our experience in India, where some states have as many as 240 million people, is that timely access to state-specific data can really make a difference in building resilience to climate change for the most affected groups. One of the investees of the BlueOrchard managed InsuResilience Investment strategy is Skymet Weather Services Private Ltd. Skymet has benefited from private equity financing and technical assistance provided by the strategy which was initiated by the German Development bank (KfW) acting on behalf of the German Ministry of Economic Cooperation and Development.

What Skymet does is “simple”. It provides weather and crop-yield related information services to the insurance sector in India via more than 4,000 automatic weather stations across the country. Our investment helped Skymet to expand its network of stations and national coverage, as well as to secure new contracts in both weather data and crop yield measurement. Skymet now reaches more than 20,000,000 farmers, allowing them to better manage the impact of climate and weather events on harvests through smartphone-available, index-based, livestock and crop insurance.

What this allows to protect is not only crops but also the livelihood of entire communities of small-holder farmers by providing them access to affordable climate insurance.

A lack of weather stations, and in turn sparse climate data, is a particular issue within Africa. Africa has the least developed land-based weather observations network in the world, with only one eighth of the minimum amount needed by the World Meteorological Organisation. Added to this, the recent Bloomberg report’s on the further closure of existing weather stations, with only 22% of current stations up to quality standards; all further limiting Africa’s climate assessment and capacity to be resilient and adapt to the impacts of climate change.

A lack of weather stations inhibits Africa’s climate ability on multiple fronts:

- From an adaptation perspective, a lack of weather stations prohibits a country’s ability to warn communities of current weather extreme events, along with planning for the level of adaptation needed for future climate change.

- Africa is dependent on natural ecosystems, with over 70% of the population dependent on agriculture, a lack of weather data, prevents farmers from understanding changing seasons, growth optimisation of crops and the overall efficiency of their production.

- Interestingly, it touches on mitigation to the same extent, through, for example, a lack of understanding on wind or river patterns, prolonging a country’s ability to construct renewable energy projects (among other barriers) due to a lack of understanding on the dependency of the power source.

- To build a functioning insurance market that has a pivotal role to play in facilitating mitigation and adaptation to natural catastrophes, including climate change. When suitably applied, insurance can become a crucial instrument to prepare for and withstand adverse events.

Loss and damage and adaptation have been key discussions topics at COP27, predominately focused around assessing risks and therefore being able to properly price required financing and insurance instruments. Whilst many can quantify the level of exposure they have or approximate the total predicted impact; African countries even start conversations on a different foot, unable to communicate on the same level, quantitatively, whilst already feeling the effects of climate change the most. Weather stations and increased data are not only needed to combat climate change but are also a key pillar for future socio-economic growth and needs to move to the forefront of the agenda in Africa.

-end-

About BlueOrchard Finance Ltd

BlueOrchard is a leading global impact investment manager and member of the Schroders Group. As a pioneering impact investor, the firm is dedicated to generating lasting positive impact for communities and the environment, while aiming at providing attractive returns to investors. BlueOrchard was founded in 2001, by initiative of the UN, as the first commercial manager of microfinance debt investments worldwide. Today, the firm offers impact investment solutions across asset classes, connecting millions of entrepreneurs in emerging and frontier markets with investors with the aim to make impact investment solutions accessible to all and to advance the conscious use of capital. Being a professional investment manager and expert in innovative blended finance mandates, BlueOrchard has a sophisticated international investor base and is a trusted partner of leading global development finance institutions. To date, BlueOrchard has invested over USD 10 billion across more than 105 countries. Over 260 million underserved people and MSMEs in emerging and frontier markets received access to financial and related services with the support of BlueOrchard as of December 2022. For additional information, please visit: www.blueorchard.com.

For further information, please contact:

Tahmina Theis

+41 44 441 55 50

tahmina.theis@blueorchard.com

Important Information

Marketing material for professional clients and for qualified investors in Switzerland only.

Please refer to the prospectus and any other legal document of a fund before making any final investment decision.

The information in this publication was produced by BlueOrchard Finance Ltd (“BOF”) to the best of its present knowledge and belief. However, all data and financial information provided is on an unaudited and “as is” basis. The opinions expressed in this publication are those of BOF and its employees and are subject to change at any time without notice. They do not necessarily reflect the opinion of Schroders Group.

BOF is part of Schroders Capital, the private markets investment division of Schroders Group.

BOF may decide to cease the distribution of any fund(s) in any EEA country at any time but we will publish our intention to do so on our website, in line with applicable regulatory requirements.

This publication is provided for marketing reasons and is not to be seen as investment research. As such it is not prepared pursuant legal requirements established for the promotion of independent investment research nor subject to any prohibition on dealing ahead of the distribution of investment research.

This publication may contain information, references or links to other publications and websites from external sources. BOF has not reviewed such other publications and websites. BOF in particular does neither guarantee that such information is complete, accurate and up-to-date nor is BOF responsible in any way in relation to the content of such publications and websites.

The information in this publication is the sole property of BOF unless otherwise noted and may not be reproduced in full or in part without the express prior written consent of BOF.

All investments involve risk. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of investments to fall as well as rise. Performance data does not take into account any commissions and costs, if any, charged when units or shares of the fund are issued and redeemed.

Emerging markets impact investments involve a unique and substantial level of risk that is critical to understand before engaging in any prospective relationship with BOF and its various managed funds. Investments in emerging markets, particularly those involving foreign currencies, may present significant additional risk and in all cases the risks implicated in this disclaimer include the risk of loss of invested capital. To understand specific risks of an investment, please refer to the currently valid legal investment documentation.

This publication may contain “forward-looking” information, such as forecasts or projections. Please note that any such information is not a guarantee of any future performance and there is no assurance that any forecast or projection will be realised. Scenarios presented are an estimate of future performance based on evidence from the past on how the value of this investment varies, and/or current market conditions and are not an exact indicator. BOF does not in any way ascertain that the statements concerning future developments will be correct. Unless this fund contains a capital guarantee, what you will get will vary depending on how the market performs and how long you keep the investment/product. Performance is subject to your individual taxation circumstances which may change in the future.

Any reference to sectors/countries/stocks/securities are for illustrative purposes only and not a recommendation to buy or sell any financial instrument/securities or adopt any investment strategy.

The materials provided in this publication are for informational purposes only and nothing in this publication can be construed as constituting any offer to purchase any product, or a recommendation/solicitation or other inducement to buy or sell any financial instrument of any kind and shall not under any circumstances be construed as absolving any reader of this publication of his/her responsibility for making an independent evaluation of the risks and potential rewards of any financial transaction.

We note in particular that none of the investment products referred to in this publication constitute securities registered under the Securities Act of 1933 (of the United States of America) and BOF and its managed/advised funds are materially limited in their capacity to sell any financial products of any kind in the United States. No investment product referenced in this publication may be publicly offered for sale in the United States and nothing in this publication shall be construed under any circumstances as a solicitation of a US Person (as defined in applicable law/regulation) to purchase any BOF investment product.

The information provided in this publication is intended for review and receipt only by those persons who are qualified (in accordance with applicable legal/regulatory definitions) in their respective place of residence and/or business to view it, and the information is not intended under any circumstances to be provided to any person who is not legally eligible to receive it.

The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Any recipient of information from this publication who wishes to engage with BOF in furtherance of any transaction or any relationship whatsoever must consult his/her own tax, legal and investment professionals to determine whether such relationship and/or transaction is suitable.

By no means is the information provided in this document aimed at persons who are residents of any country where the product mentioned herein is not registered or approved for sale or marketing or in which dissemination of such information is not permitted.

Persons who are not qualified to obtain such publication are kindly requested to discard it or return it to the sender.

BOF disclaims all liability for any direct or indirect damages and/or costs that may arise from the use of (whether such use is proper or improper), or access to, this publication (or the inability to access this publication).

The BlueOrchard managed funds have the objective of sustainable investment within the meaning of Article 9 Regulation (EU) 2019/2088 on Sustainability related Disclosure in the Financial Services Sector (the SFDR). For information on sustainability related aspects of this fund please go to https://www.blueorchard.com/sustainability-disclosure-documents/ .

Investment or other decisions should be made solely on the basis of the relevant legal fund and investment product documents (prospectus/offering memorandum, fund contract/articles, key information documents, financial reports etc.).

It is important that you read the relevant fund and investment product documents before you invest in financial instruments to ensure that you understand the investment policy, expenses, specific risks involved and other important matters, to determine whether it is a suitable product for you.

Third party data is owned or licensed by the data provider and may not be reproduced or extracted and used for any other purpose without the data provider’s consent. Third party data is provided without any warranties of any kind. The data provider and issuer of the document shall have no liability in connection with the third-party data. The Prospectus contains additional disclaimers which apply to the third-party data.

For readers in Switzerland: Marketing material for professional clients and qualified investors only. This document has been issued by BlueOrchard Finance Ltd, Seefeldstrasse 233, 8008 Zurich, a manager of collective assets authorised and supervised by the Swiss Financial Market Supervisory Authority FINMA, Laupenstrasse 27, CH-3003 Bern.

BOF has outsourced the provision of IT services (operation of data centers, data storage, etc.) to Schroders group companies in Switzerland and abroad. A sub-delegation to third parties including cloud-computing service providers is possible. The regulatory bodies and the audit company took notice of the outsourcing and the data protection and regulatory requirements are observed.

A summary of investor rights may be obtained from https://www.blueorchard.com/imprint/

Copyright © 2023, BlueOrchard Finance Ltd. All rights reserved.