The world relies on data connectivity. When the global economy ground to a halt through Covid-19, developed economies transitioned fairly seamlessly to working from home (WFH), and the recovery was swifter than initially expected.

Emerging markets have not seen the same step-change in access, affordability and quality of service. But it’s about far more than access to Zoom or Netflix. If you live rurally in an emerging economy, financial services might be completely inaccessible. Similarly, opportunities for education and meeting healthcare needs are drastically reduced without internet access. It is a major impediment to fulfilling potential, and women are often disproportionately hard-hit.

Research by World Economic Forum indicates that for each additional 10 percentage points of internet penetration, a country can add 1.2 percentage points to per capita GDP. Adding 10 percentage points of the population to broadband could boost per capita GDP by almost 1.4%.

It’s not a simple fix. There are major challenges in connecting emerging economies to the internet, but we see huge opportunities for those willing to overcome the obstacles.

The challenge

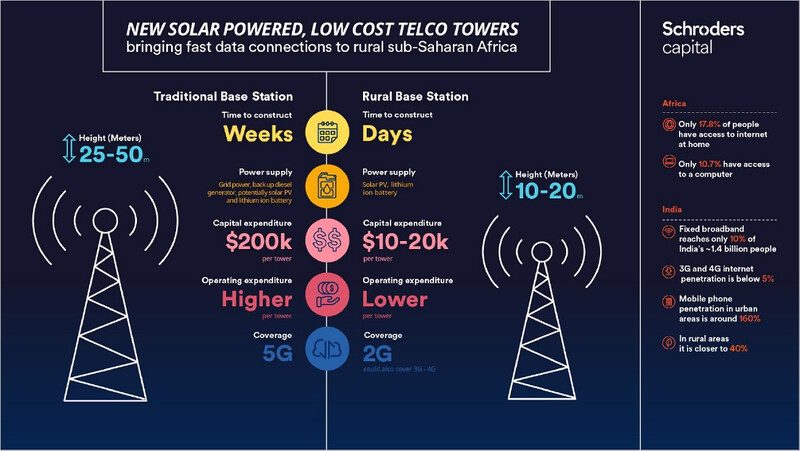

Around the world, some 4.5 billion people lack internet access. In Africa only 17.8% of people have access to internet at home and only 10.7% have access to a computer. Fixed broadband reaches only 10% of India, and 3G and 4G internet penetration is below 5%, with stark inequality between rural and urban areas. Mobile penetration in urban areas is around 160%, while in rural areas it is closer to 40%.

Addressing this lack of digital infrastructure and internet access is about far more than access to leisure and convenience. World Bank data can draw a direct line between digital economy and levels of development, while mobile broadband penetration is positively correlated with income per capita. More of the Indian population has a mobile phone than a bank account.

So why isn’t it being built out more aggressively?

There is a chicken and egg problem with rolling out digital infrastructure in emerging markets.

There is a widespread lack of “last mile” infrastructure, as well as a paucity of internet exchanges and data centres, which makes for slower, more expensive internet access.

Internet exchange points (IXPs) are essentially data centres that sit in well-position locations that enable different network operators to speak to one another. The benefits are to reduce the physical distance that traffic needs to travel; improving speed and reducing costs for the internet service providers. This in turn reduces the cost to the customers. They also lower barriers of entry, as firms can leverage existing infrastructure. 90% of high-income countries have at least one IXP, compared with 69% for low-income countries. In addition, while 53% of high-income countries have data centre to cloud connectivity, no low-income countries have the ability to decentralise data storage this way.

The problem is that the cost of smart devices and data packages for emerging markets – particularly in rural areas – is still extremely high. A smart phone can cost 80% of average monthly income in poor countries, compared with only 13% within high income countries.

As a consequence, there is little appetite amongst mobile network data firms to install, nor for TowerCos to own assets that currently have little demand or low utilisation rates. Lack of electricity or reliable electricity can add to operational complexity, and further load the cost.

Someone has to move first

There are solutions, but they require investors to provide capital to build infrastructure that can bridge the gap, improve access and reduce costs. Connection speeds can be improved, and costs reduced by increasing local (or closer) data centres. Pay-as-you-go business models can make it easier to acquire smart phones. There are also comparatively simple ways to provide access through low cost TowerCo solutions in rural areas.

We are in the final stages of providing finance to a project to provide base station telco infrastructure to rural locations in Africa. This will allow mobile network operators to provide voice, data and SMS services to customers in rural areas. This type of tower costs around USD 10,000 to build versus a traditional base station which is closer to USD 200,000.

The new technology bringing data connection to rural areas in EM

The tower is a low power consumption facility and is therefore capable of powering itself solely using solar photovoltaic (PV) and batteries. The operational cost of these towers is also very low, with the solar panels requiring no fuel and few moving parts, versus the diesel generators that provide backup power for traditional towers.

The rural tower can cover around three to five square kilometres, and one tower is sufficient to bring connectivity to a typical rural village. At the moment the plans are to build the towers in Nigeria, Cameroon and Democratic Republic of Congo, but also other markets in west and central Africa. We’re also considering further activity in Rwanda, South Africa, Benin and Nigeria.

A new paradigm

Imagine a bike race where the starter pistol sounds, and three quarters of the competitors have to bolt the wheels on before they can chase those already racing. Innovative technologies like these new telco towers are vital to creating a more level playing field for emerging economies. For the concept of the “just transition” – building greater resilience to climate change for communities it threatens most – tools promoting financial independence, social mobility and economic security are key, and investors can enable their development.

– end –

For further information, please contact:

BlueOrchard

Tahmina Theis

+41 22 596 47 69

tahmina.theis@blueorchard.com

Disclaimer

The information in this publication was produced by BlueOrchard Finance Ltd (“BOF”) to the best of its present knowledge and belief. However, all data and financial information provided is on an unaudited and “as is” basis. The opinions expressed in this publication are those of BOF and its employees and are subject to change at any time without notice. BOF provides no guarantee with regard to the accuracy and completeness of the content in this publication and BOF does not under any circumstance, accept liability for any losses or damages which may arise from making use of, or relying upon any information, content or opinion provided by BOF in this publication. This publication may contain references or links to other publications and websites and BOF has not reviewed such other publications and websites and is not responsible in any way in relation to the content of such publications and websites. The information in this publication is the sole property of BOF unless otherwise noted, and may not be reproduced in full or in part without the express prior written consent of BOF. All investments involve risk. We note specifically that past performance is not an indication of future results. Emerging markets impact investments involve a unique and substantial level of risk that is critical to understand before engaging in any prospective relationship with BOF and its various managed funds. Investments in emerging markets, particularly those involving foreign currencies, may present significant additional risk and in all cases the risks implicated in this disclaimer include the risk of loss of invested capital. The materials provided in this publication are for informational purposes only and nothing in this publication can be construed as constituting any offer to purchase any product, or a recommendation/solicitation or other inducement to buy or sell any financial instrument of any kind and shall not under any circumstances be construed as absolving any reader of this publication of his/her responsibility for making an independent evaluation of the risks and potential rewards of any financial transaction. We note in particular that none of the investment products referred to in this publication constitute securities registered under the Securities Act of 1933 (of the United States of America) and BOF and its managed/advised funds are materially limited in their capacity to sell any financial products of any kind in the United States. No investment product referenced in this publication may be publicly offered for sale in the United States and nothing in this publication shall be construed under any circumstances as a solicitation of a US Person (as defined in applicable law/regulation) to purchase any BOF investment product. The information provided in this publication is intended for review and receipt only by those persons who are qualified (in accordance with applicable legal/regulatory definitions) in their respective place of residence and/or business to view it, and the information is not intended under any circumstances to be provided to any person who is not legally eligible to receive it. Any recipient of information from this publication who wishes to engage with BOF in furtherance of any transaction or any relationship whatsoever must consult his/her own tax, legal and investment professionals to determine whether such relationship and/or transaction is suitable. By no means is the information provided in this document aimed at persons who are residents of any country where the product mentioned herein is not registered or approved for sale or marketing or in which dissemination of such information is not permitted. BOF disclaims all liability for any direct or indirect damages and/or costs that may arise from the use of (whether such use is proper or improper), or access to, this publication (or the inability to access this publication).

Copyright © 2022, BlueOrchard Finance Ltd. All rights reserved.