Schroder International Selection Fund BlueOrchard Emerging Markets Climate Bond (“CBF”)

- Climate action investing with a targeted bonds strategy

- Actively managed investment process

- Proprietary impact framework

Our investment goals and strategy

Liquid climate bonds

This fund gives you access to a scalable UCITS climate bond strategy with daily liquidity. As well as being actively managed, it is benchmark agnostic, so our investment managers are free to pursue the most suitable outcomes for you.

A robust platform

As a member of the Schroders Group, we benefit from being able to access the Schroder International Selection Fund (Schroder ISF).

Green objectives

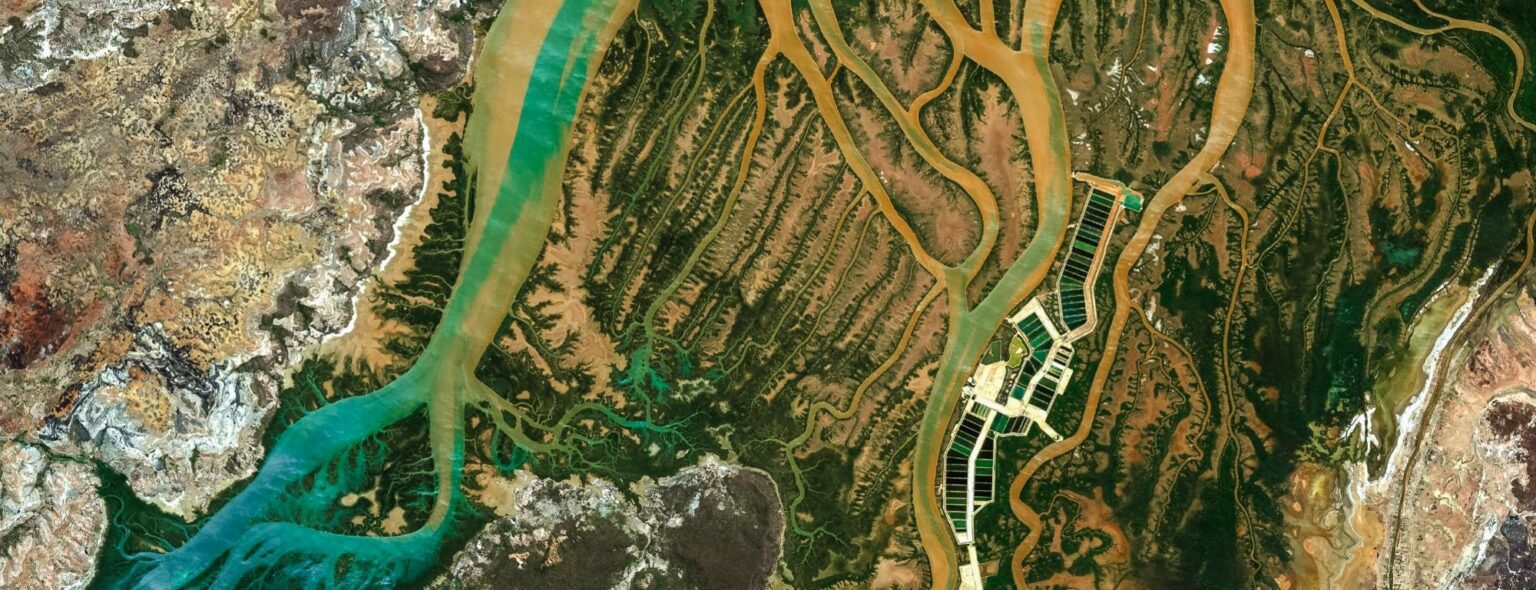

Looking to tackle climate change and support markets that are vulnerable to its effects? We do this by combining climate action issuers and bonds (such as green and sustainability-linked bonds) with an emerging markets focus.

Fund characteristics

| Fund inception | June 2021 |

| Asset class | Listed debt |

| Status | Fundraising |

| Liquidity | Daily for subscriptions and redemptions |

| Domicile and legal structure | Luxembourg, SICAV, UCITS |

| SFDR classification | Article 9 |

| External AIFM | Schroder Investment Manager (Europe) S.A. |

| Investment manager | BlueOrchard Finance Ltd |

| Custodian bank | J.P. Morgan Bank Luxembourg S.A. |

SDGs addressed

Core SDGs

Aligned SDGs

Core SDGs: Core SDGs are those that address the impact intent and/or sustainability investment objective of a given fund.

Aligned SDGs: Aligned SDGs are those that the fund’s investees promote through responsible ESG management practices.

Impact indicators

Contact