Avoiding downside is a major and recurring theme in credit investing. We believe that, with limited anticipated defaults, tight credit spreads, and strong global growth, 2025 will be a year to focus on income.

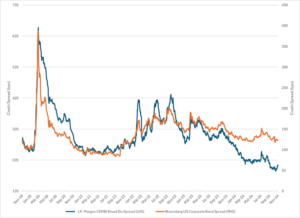

Emerging markets’ corporate credit spreads are tight, both on a historical level—with the J.P. Morgan CEMBI Broad Div Spread at 209 basis points (November 2024, versus a five-year average of 308 bps)—and on a relative basis compared to their developed market counterparts (see chart below).

However, we believe these valuations are justified by very strong fundamentals. Defaults in emerging markets corporates are close to their historical lows, with JPM expecting EM corporate defaults to be below 1% in 2025. Investment-grade corporate financial leverage in emerging markets has decreased from 1.4 in 2014 to 0.9 in 2024 and is significantly lower than that of developed market counterparts. In addition to reducing the probability of default, lower leverage is decreasing supply, which has a direct impact on pricing. The year 2024 has, for the first time since 2012, seen more ratings upgraded than downgraded across emerging markets. We also expect that better demographics in emerging markets will help continue a strong long-term growth trend. So, while emerging market credit spreads may appear low, we believe that this valuation is justified by lower expected risks.

(Bloomberg / JP Morgan)

While spreads are not particularly attractive, real rates in USD are close to their highest levels seen in recent history, with only 2020 showing a better level. CPI is expected to be 2.4% in 2025, while the Fed rate is anticipated to be cut from 4.75% to 3.8% by the end of the same year. There is, of course, a risk of rates going higher. Political risks play a role in this potential scenario, as immigration policy and protectionist trade initiatives could lead to a bounce back in inflation. Budget deficits could lead to an increase in Treasury supply, and the new US administration could cause some headlines that unsettle global markets.

By focusing on the shorter end of the curve, investors could reduce sensitivity to interest rate movements while concentrating on income. We also see potential benefits in a diversified durational exposure through the addition of EUR duration. We feel that, overall, in the current market conditions, it is possible to build a bond portfolio that provides an attractive yield to maturity without taking on significant market or underlying credit risk.

(Bloomberg / JP Morgan)

On the external side, we see potential for volatility driven by a trade wars, shooting wars, geopolitical risks, and monetary policy dispersion. While hard currency bonds have, by definition, no exposure to emerging market foreign exchange, those external elements can still affect credit quality.

We believe that companies benefiting from a weaker local currency or those managing their assets and liabilities appropriately will benefit from a stronger dollar. This is the case for some exporters, which benefit from local currency costs and hard currency income.

We have also observed strong dispersion during 2024 as major economies have increasingly decoupled. While China experienced slowed growth, India boomed, and Turkey made significant efforts towards economic stabilisation. We have also seen a pattern of political risk premiums in Latin America and Eastern Europe, with both regions offering idiosyncratic return potential. These political risks and economic divergences not only create risks but also dispersion, providing opportunities for active management to generate value.

For example, at BlueOrchard, we are focusing on short-term high-yield names with state support, such as banks in Uzbekistan, real estate issuers that may benefit from local rates, and corporates with good maturity profiles that reduce refinancing and liquidity risk.

Further south, we are also anticipating some value opportunities within African supranational issuances that may present attractive valuations and liquid access to exposures on the African continent. Asian issuers with particularly strong credit metrics and access to onshore liquidity can be utilised to increase resilience in a geographically diversified portfolio.

The figure below shows the differential evolution of credit default swap spreads (a credit default swap is a financial derivative contract that allows an investor to “swap” or transfer the credit risk of a borrower to another party). This metric serves as a good example of the attractive opportunity set available to emerging market investors.

While an environment in which all credit spreads move in the same way tends to limit the value of an active view, the fact that some names outperform (Argentina, Hungary, Turkey) and others underperform (Mexico, Colombia, Brazil) creates an environment conducive to relative value views.

(Bloomberg)

Overall, we believe that 2025 will be a particularly attractive year to own fixed income assets, on account of what we expect to be high yield and relatively low volatility. The fixed income market’s rate component, which is now negatively correlated to equity, also makes it particularly additive to a multi-asset portfolio.

By investing at the shorter end of the interest rate curve, one can look to reduce exposure to volatility and focus on income. The prospect of extra returns in the credit markets is, we believe, quite strong in 2025, but investors have to do their homework in order to capture the risk premiums and circumstantial benefits we’ve discussed above. A well-informed and focused credit investor can go into 2025 in a strong position to capitalise on a changing world and the idiosyncratic valuations it may present.

-end-

Important Information

This document was produced by BlueOrchard Finance Ltd (“BOF”) to the best of its present knowledge and belief. Information herein is believed to be reliable, but BOF does not warrant its completeness or accuracy. BOF has expressed its own views and opinions in this document, and these may change. They do not necessarily reflect the opinion of Schroders Group.

BOF is part of Schroders Capital, the private markets investment division of Schroders Group.

This information is a marketing communication and is not to be seen as investment research. As such it is not prepared pursuant legal requirements established for the promotion of independent investment research nor subject to any prohibition on dealing ahead of the distribution of investment research.

The information in this document is the sole property of BOF unless otherwise noted and may not be reproduced in full or in part without the express prior written consent of BOF.

Any reference to sectors/countries/stocks/securities are for illustrative purposes only and not a recommendation to buy or sell any financial instrument/securities or adopt any investment strategy.

All investments involve risks. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of investments to fall as well as rise. Performance data does not take into account any commissions and costs, if any, charged when units or shares of the fund are issued and redeemed.

Emerging markets impact investments involve a unique and substantial level of risk that is critical to understand before engaging in any prospective relationship with BOF and its various managed funds. Investments in emerging markets, particularly those involving foreign currencies, may present significant additional risk and in all cases the risks implicated in this disclaimer include the risk of loss of invested capital. To understand specific risks of an investment, please refer to the currently valid legal investment documentation.

This document may contain “forward-looking” information, such as forecasts or projections. Please note that any such information is not a guarantee of any future performance and there is no assurance that any forecast or projection will be realised. Scenarios presented are an estimate of future performance based on evidence from the past on how the value of this investment varies, and/or current market conditions and are not an exact indicator. BOF does not in any way ascertain that the statements concerning future developments will be correct. Unless this fund contains a capital guarantee, what you will get will vary depending on how the market performs and how long you keep the investment/product. Performance is subject to your individual taxation circumstances which may change in the future.

This document does not constitute an offer to anyone, or a solicitation by anyone, to subscribe for shares of a fund managed or advised by BOF. Nothing in this document should be construed as advice and is therefore not a recommendation to buy or sell shares. An investment in a fund entails risks, which are fully described in the fund’s legal documents.

We note in particular that none of the investment products referred to in this document constitute securities registered under the Securities Act of 1933 (of the United States of America) and BOF and its managed/advised funds are materially limited in their capacity to sell any financial products of any kind in the United States. No investment product referenced in this document may be publicly offered for sale in the United States and nothing in this document shall be construed under any circumstances as a solicitation of a US Person (as defined in applicable law/regulation) to purchase any BOF investment product.

The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations.

By no means is the information provided in this document aimed at persons who are residents of any country where the product mentioned herein is not registered or approved for sale or marketing or in which dissemination of such information is not permitted. Persons who are not qualified to obtain such document are kindly requested to discard it or return it to the sender.

No Schroders entity nor BOF accept any liability for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise), in each case save to the extent such liability cannot be excluded under applicable laws.

The BlueOrchard managed funds have the objective of sustainable investment within the meaning of Article 9 Regulation (EU) 2019/2088 on Sustainability related Disclosure in the Financial Services Sector (the SFDR). For information on sustainability related aspects of this fund please go to https://www.blueorchard.com/sustainability-disclosure-documents/ .

The fund’s prospectus, key investor information if any and annual reports are available free of charge upon request at BlueOrchard Asset Management (Luxembourg) S.A., 1 rue Goethe, L-1637 Luxembourg. The prospectus and the Key Investor Information for Switzerland, if any, the articles, the interim and annual reports, the list of purchases and sales and other information can be obtained free of charge from the representative in Switzerland: 1741 Fund Solutions AG, Burggraben 16, 9000 St. Gallen. The paying agent in Switzerland is Bank Tellco AG, Bahnhofstrasse 4, 6430 Schwyz.

BOF may decide to cease the distribution of any fund(s) in any EEA country at any time but we will publish our intention to do so on our website, in line with applicable regulatory requirements.

Third party data is owned or licensed by the data provider and may not be reproduced or extracted and used for any other purpose without the data provider’s consent. Third party data is provided without any warranties of any kind. The data provider and issuer of the document shall have no liability in connection with the third-party data. The Prospectus contains additional disclaimers which apply to the third-party data.

Source: MSCI

MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

BOF has outsourced the provision of IT services (operation of data centers, data storage, etc.) to Schroders group companies in Switzerland and abroad. A sub-delegation to third parties including cloud-computing service providers is possible. The regulatory bodies and the audit company took notice of the outsourcing and the data protection and regulatory requirements are observed.

A summary of investor rights may be obtained from https://www.blueorchard.com/imprint/

Copyright © 2024, BlueOrchard Finance Ltd. All rights reserved.