The evolution of emerging market economies

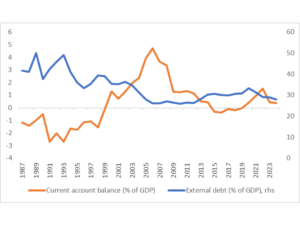

Historically, emerging markets (EM) were considered high-risk due to their economic instability. However, several fundamental changes have contributed to a shift in this perception. First and foremost, many EM have substantially improved their fiscal positions by reducing their fiscal deficits through disciplined budget management and revenue generation. According to data from Bloomberg, EM had an average deficit of -2.6% from 2000 to 2022, compared to -3.4% for Developed Economies. This has resulted in a decreased reliance on external financing. IMF data shows that external financing for EM has decreased from a high of 50% in 1989 to an anticipated level of 28% by the end of 2024. Additionally, many EM have seen a significant reduction in current account deficits, driven by a combination of increased exports and reduced imports. Thailand serves as a good example, with an average current account surplus of 3.4% from 2012 to 2022 (IMF). The country has benefitted from a rise in manufacturing exports and its strong tourism sector. This shift has made their economies more resilient to sudden capital outflows.

Source: BlueOrchard, Bloomberg, IMF

Finally, structural reforms in areas such as banking, labour, and trade have resulted in improved governance and increased economic stability in many EM (IMF). These reforms have enhanced the business environment and promoted economic growth. A study by the IMF has shown that well-calibrated reforms, particularly those addressing governance, business regulation, and external sector constraints, can have a significant positive impact on economic growth, boosting output by 4% in two years and 8% in four years, even in the presence of limited policy space. Uruguay is one of the countries in Latin America that has implemented various reforms in recent years, adjusting its fiscal framework and introducing a pension reform that improves the sustainability of the system (Fitch).

Improved credit fundamentals in emerging markets

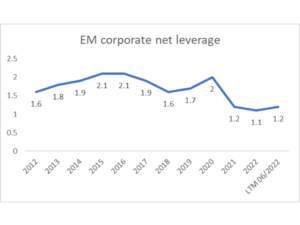

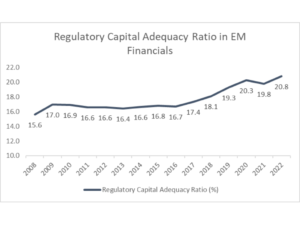

The credit fundamentals of companies in emerging markets have significantly improved in recent years. In the corporate sectors, there has been a noteworthy decrease in leverage for hard currency bond issuers. This makes companies less vulnerable to economic shocks and more appealing to investors. An analysis from JP Morgan in August 2023 of over 200 corporate issuers shows that Net Leverage decreased from a peak of 2.1x in 2016 to a moderate level of 1.2x in June 2023. Furthermore, the Interest Coverage Ratio has improved and is currently at a high level of 9.3x. These enhanced credit metrics provide companies with an adequate buffer to face increased refinancing costs in the coming years. Financial institutions have also improved asset quality and capital adequacy through reforms across countries. According to S&P data, the Regulatory Capital Adequacy Ratio across EM improved from 16.6% in 2012 to 20.8% as of FY22.

Source: BlueOrchard, JPMorgan

Source: BlueOrchard, S&P

Conclusion

Understanding EM risks in the current economic climate is imperative for making informed investment decisions. The transformation of EM economies and the improvement in credit fundamentals have led to a shift in the risk profile of these markets. Factors such as decreased corporate leverage, improved capitalisation of financial institutions, and overall economic stability have all contributed to this change. However, dispersions across markets remain high, underscoring the importance of closer examination and active management in this environment.

– ends –

Any reference to sectors/countries/stocks/securities are for illustrative purposes only and not a recommendation to buy or sell any financial instrument/securities or adopt any investment strategy.

For further information, please contact:

Tahmina Theis

+41 22 596 47 69

tahmina.theis@blueorchard.com

-end-

Important Information

This document was produced by BlueOrchard Finance Ltd (“BOF”) to the best of its present knowledge and belief. Information herein is believed to be reliable, but BOF does not warrant its completeness or accuracy. BOF has expressed its own views and opinions in this document, and these may change. They do not necessarily reflect the opinion of Schroders Group.

BOF is part of Schroders Capital, the private markets investment division of Schroders Group.

This information is a marketing communication and is not to be seen as investment research. As such it is not prepared pursuant legal requirements established for the promotion of independent investment research nor subject to any prohibition on dealing ahead of the distribution of investment research.

The information in this document is the sole property of BOF unless otherwise noted and may not be reproduced in full or in part without the express prior written consent of BOF.

Any reference to sectors/countries/stocks/securities are for illustrative purposes only and not a recommendation to buy or sell any financial instrument/securities or adopt any investment strategy.

All investments involve risks. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of investments to fall as well as rise. Performance data does not take into account any commissions and costs, if any, charged when units or shares of the fund are issued and redeemed.

Emerging markets impact investments involve a unique and substantial level of risk that is critical to understand before engaging in any prospective relationship with BOF and its various managed funds. Investments in emerging markets, particularly those involving foreign currencies, may present significant additional risk and in all cases the risks implicated in this disclaimer include the risk of loss of invested capital. To understand specific risks of an investment, please refer to the currently valid legal investment documentation.

This document may contain “forward-looking” information, such as forecasts or projections. Please note that any such information is not a guarantee of any future performance and there is no assurance that any forecast or projection will be realised. Scenarios presented are an estimate of future performance based on evidence from the past on how the value of this investment varies, and/or current market conditions and are not an exact indicator. BOF does not in any way ascertain that the statements concerning future developments will be correct. Unless this fund contains a capital guarantee, what you will get will vary depending on how the market performs and how long you keep the investment/product. Performance is subject to your individual taxation circumstances which may change in the future.

This document does not constitute an offer to anyone, or a solicitation by anyone, to subscribe for shares of a fund managed or advised by BOF. Nothing in this document should be construed as advice and is therefore not a recommendation to buy or sell shares. An investment in a fund entails risks, which are fully described in the fund’s legal documents.

We note in particular that none of the investment products referred to in this document constitute securities registered under the Securities Act of 1933 (of the United States of America) and BOF and its managed/advised funds are materially limited in their capacity to sell any financial products of any kind in the United States. No investment product referenced in this document may be publicly offered for sale in the United States and nothing in this document shall be construed under any circumstances as a solicitation of a US Person (as defined in applicable law/regulation) to purchase any BOF investment product.

The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations.

By no means is the information provided in this document aimed at persons who are residents of any country where the product mentioned herein is not registered or approved for sale or marketing or in which dissemination of such information is not permitted. Persons who are not qualified to obtain such document are kindly requested to discard it or return it to the sender.

No Schroders entity nor BOF accept any liability for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise), in each case save to the extent such liability cannot be excluded under applicable laws.

The BlueOrchard managed funds have the objective of sustainable investment within the meaning of Article 9 Regulation (EU) 2019/2088 on Sustainability related Disclosure in the Financial Services Sector (the SFDR). For information on sustainability related aspects of this fund please go to https://www.blueorchard.com/sustainability-disclosure-documents/ .

The fund’s prospectus, key investor information if any and annual reports are available free of charge upon request at BlueOrchard Asset Management (Luxembourg) S.A., 1 rue Goethe, L-1637 Luxembourg. The prospectus and the Key Investor Information for Switzerland, if any, the articles, the interim and annual reports, the list of purchases and sales and other information can be obtained free of charge from the representative in Switzerland: 1741 Fund Solutions AG, Burggraben 16, 9000 St. Gallen. The paying agent in Switzerland is Bank Tellco AG, Bahnhofstrasse 4, 6430 Schwyz.

BOF may decide to cease the distribution of any fund(s) in any EEA country at any time but we will publish our intention to do so on our website, in line with applicable regulatory requirements.

Third party data is owned or licensed by the data provider and may not be reproduced or extracted and used for any other purpose without the data provider’s consent. Third party data is provided without any warranties of any kind. The data provider and issuer of the document shall have no liability in connection with the third-party data. The Prospectus contains additional disclaimers which apply to the third-party data.

Source: MSCI

MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

BOF has outsourced the provision of IT services (operation of data centers, data storage, etc.) to Schroders group companies in Switzerland and abroad. A sub-delegation to third parties including cloud-computing service providers is possible. The regulatory bodies and the audit company took notice of the outsourcing and the data protection and regulatory requirements are observed.

A summary of investor rights may be obtained from https://www.blueorchard.com/imprint/

Copyright © 2023, BlueOrchard Finance Ltd. All rights reserved.