The untapped opportunity to create meaningful impact

Technology advancements and efficiency improvements are driving the green transition, resulting in more scalable and affordable solutions. The cost of renewable energy has significantly decreased and some forms such as solar are even less expensive than the cheapest fossil fuel-fired energy sources[1]. Simultaneously, private markets investors are increasing their allocations to climate solutions with the aim to mitigate climate change and decarbonise their portfolios. Investments in emerging economies are particularly well-suited to achieve these impact and financial goals.

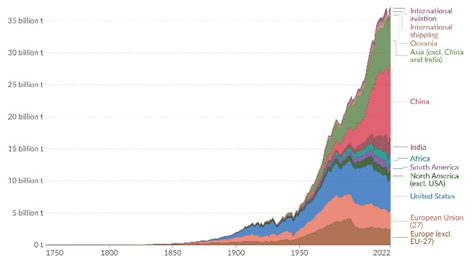

Of the $1.3 trillion invested globally in climate finance in 2022[2], only 16% reached Least Developed Countries (LDCs[3]) and Emerging Market and Developing Economies (EMDEs[4]), excluding China, which continue to heavily rely on coal in their energy mix. Furthermore, these economies tend to have lower per capita emissions but relatively high rates of carbon intensity and population growth (Figure 1[5]). Through specialised climate impact strategies investors can participate in the economic growth and climate transition of these markets while generating returns with upside potential.

Figure 1: Annual CO2 emissions by world region (top), Per capita CO2 emissions (below)

In addition to tailwinds from demographics and decarbonisation, the growing private markets offer rich opportunities to invest in sectors such as transportation, agriculture, risk management data, food systems and natural capital. Furthermore, there are clear connections between the economic rationale and quantifiable impact of such investments. To capture the complexity premium inherent in these opportunities, it is crucial to partner with managers that have the skill and experience in underwriting and measuring both financial and impact considerations.

The energy transition megatrend

Emerging markets are expected to drive global population and income growth in forthcoming years[1]. Africa’s population is on track to double by 2050[2]. India, already the world’s most populated country, is forecasted to become the 3rd largest economy by 2027[3]. Investments in renewable energy and clean transportation represent commercially attractive bets on the megatrends of demographics and decarbonisation. Fleets of electric vehicles for public transport, industry, and households help alleviate pollution from traffic smog in megacities. Renewable energy can electrify rural areas where many people still live without reliable access to energy. Technological developments driving down the entry cost for renewables, together with the liberalisation of renewable energy markets, set the stage for off-grid distribution improvement and direct energy access to industry and households.

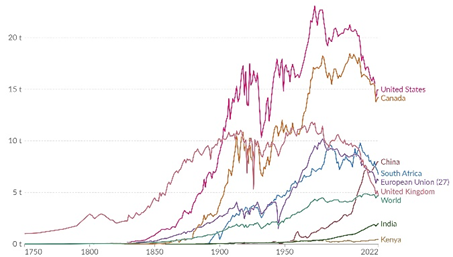

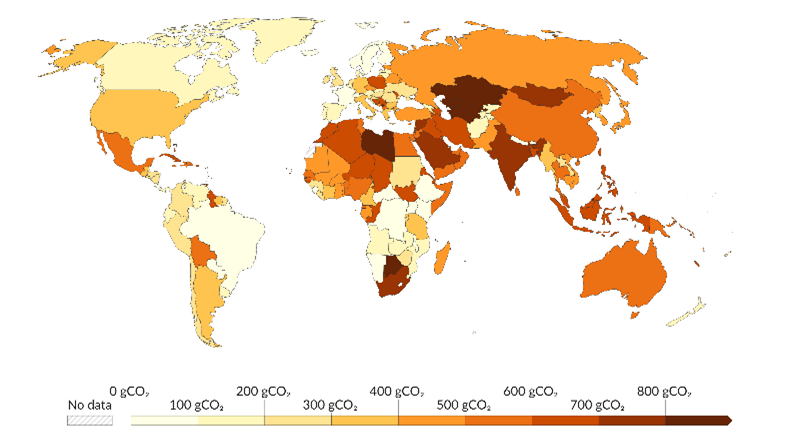

On the supply side, Africa’s mining and minerals sectors and Asia’s battery assembly chain will have a key role to play in electrification. These regions have among the highest carbon intensity by unit of electricity generated (Figure 2[4]), and the primary cause lies in the power mix (Figure 3[5]). Both regions heavily rely on gas and coal, given the abundance of these resources in Africa and Middle East and Northern Africa (MENA), and the cheap availability of coal and brown energy in the Asian region. It is of global relevance that these sectors develop sustainably, and that the energy mix of developing and emerging market economies is shifted towards greener resources. Supportive policy and development capital are driving progress in these areas and de-risking these sectors for private capital investment.

Figure 2. Carbon intensity of electricity generation, CO2gr/kWh (including carbon dioxide equivalents)

Figure 3. Electricity supply mix by region (2020)

Adaptation: improving societal resilience

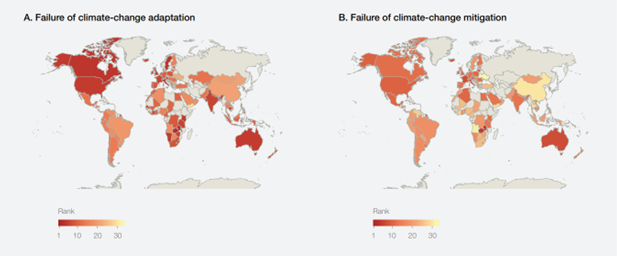

Beyond decarbonisation, it is crucial to bolster societal resilience in emerging markets, which suffer disproportionately from current and impending near-term effects of escalating pollution and climate change (Figure 4[1]), with the top 10 most vulnerable countries located in South-East, Central and Pacific Asia and Latin America[2]. Facilitating access to agricultural insurance products helps households and small and medium-sized enterprises (SMEs) manage risks and ensure business continuity. Natural disasters and unpredictable weather pose significant challenges for businesses, and specialised impact strategies are addressing this specific need. Additionally, climate-resilient infrastructure can dampen the impact of catastrophes on livelihoods. Leveraging advancements in satellite data technologies and GPS analytics enables communities to have real-time tracking and weather data, democratising climate risk management practices and turning uncertainty into preparedness.

Figure 4: National risk perception of climate action failure, World Economic Forum Executive Opinion Survey 2022

Natural capital: strengthening our best defences

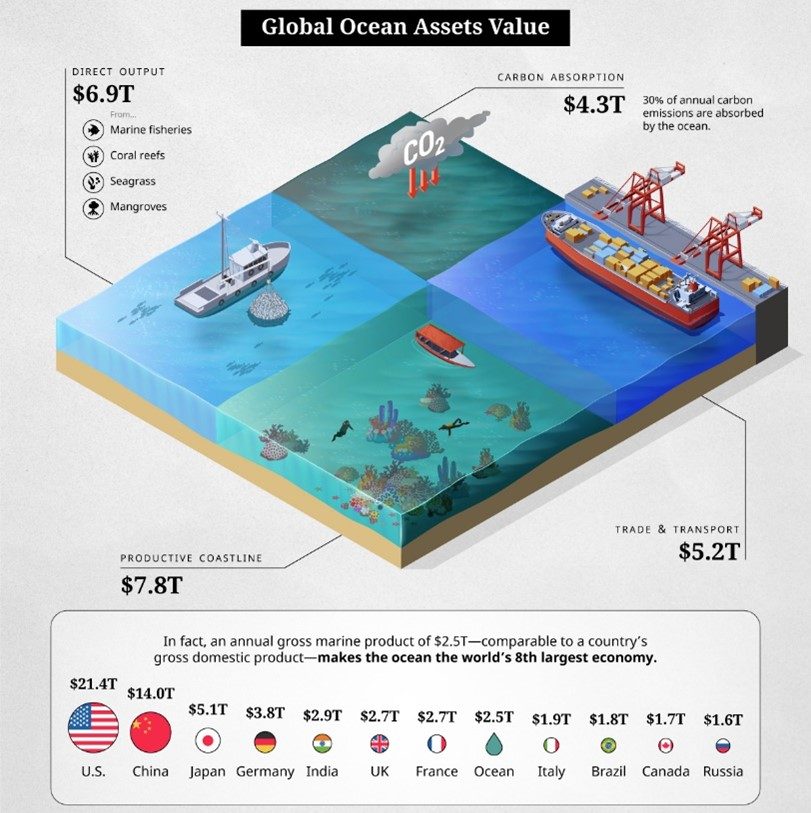

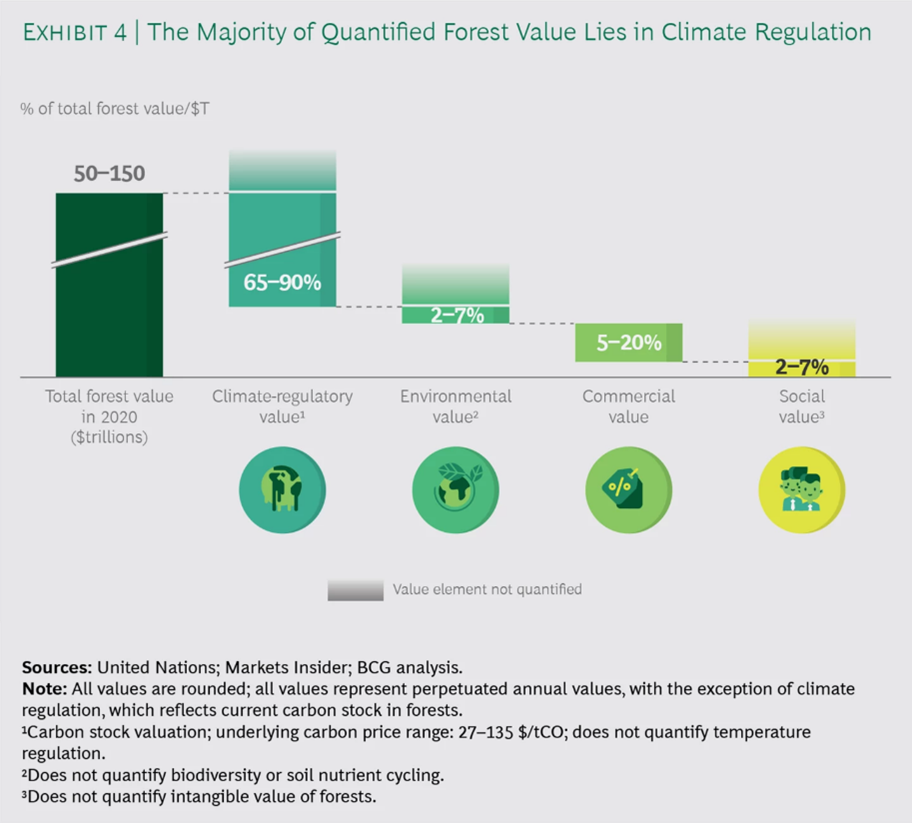

There exists a substantial funding gap and sizeable investment opportunity in the realm of natural capital. Healthy oceans and forests play a vital role in capturing carbon dioxide, and EMs are home to some of the planet’s most important terrestrial and marine ecosystems on the planet. While still nascent, the investment opportunity in the natural capital of EMs is very promising. For example, the Blue Economy[1] is valued at $2.5trillion, which is comparable to the GDP of France (Figure 5[2]). The estimated total value of the world’s forests is as much as $150 trillion, nearly double the value of global stock markets, and their ability to store carbon accounts for up to 90% of this potential value (Figure 6[3]).

The oceans’ carbon sink feature depends on the water acidity and alkalinity balance; a delicate equilibrium relying on carbon concentration and life below water. Sustainable aquaculture is one impact investment strategy that, if done correctly, can alleviate stresses on ocean ecosystems while simultaneously offering a solution to feed growing populations with increasing incomes in fast-developing economies. Another approach is to create economic incentives for agroforestry producers to maintain production levels that are healthy for local ecosystems and thereby foster biodiversity. Finally, leading sustainable forestry managers are redefining the business by coupling timber production with biodiversity preservation and carbon initiatives on land that are the most at risk of deforestation. There are proven and profitable models accomplishing this, which can be replicated and expanded.

Figure 5. Global Ocean estimated asset value, and Global Marine Product vs. GDPs

Figure 6. The economic potential of carbon in Forestry

Conclusion

Addressing decarbonisation and climate solutions through private markets is a clear focus for the members of the Paris Aligned Asset Owners Initiative, which collectively oversees $3.3 trillion of assets[1]. Investments in these areas can drive the energy transition and preserve dwindling natural capital while generating compelling sustainable returns. Nowhere is this story truer than in the emerging world, which stands to suffer from strong climate change events while facing substantial climate funding challenges.

So far, the public sector and development banks have taken the lead in climate investments in emerging markets[2]. However, significant improvements in technology and policy, combined with demographic and economic tailwinds, are changing the investment landscape in these countries and giving rise to attractive opportunities for growth-oriented investors. Specialised managers with experience in emerging markets private investments are best suited to navigate these diverse and idiosyncratic environments, thus unlocking the potential for financial returns and lasting impact.

-end-

Important Information

Marketing material.

The information in this document was produced by BlueOrchard Finance Ltd (“BOF”), a member of the Schroders Group.

Past performance is not a guide to future performance and may not be repeated.

The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of any overseas investments to rise or fall.

BOF has expressed its own views and opinions in this document and these may change without notice.

Information herein is believed to be reliable but BOF does not warrant its completeness or accuracy.

The data contained in this document has been sourced by BOF and should be independently verified. Third party data is owned or licenced by the data provider and may not be reproduced, extracted, or used for any other purpose without the data provider’s consent. Neither BOF nor the data provider will have any liability in connection with the third party data.

The terms of the third party’s specific disclaimers, if any, are set forth in the Important Information section at www.blueorchard.com/legal-documents/.

This document may contain “forward-looking” information, such as forecasts or projections. Please note that any such information is not a guarantee of any future performance and there is no assurance that any forecast or projection will be realised.

BOF has outsourced the provision of IT services (operation of data centres, data storage, etc.) to Schroders group companies in Switzerland and abroad. A sub-delegation to third parties including cloud-computing service providers is possible. The regulatory bodies and the audit company took notice of the outsourcing and the data protection and regulatory requirements are observed.

For information on how BOF and the Schroders Group may process your personal data, please view the BOF Privacy Policy available at www.blueorchard.com/legal-documents/ and the Schroders’ Privacy Policy at https://www.schroders.com/en/global/individual/footer/privacy-statement/ or on request should you not have access to these webpages.

Issued by BlueOrchard Finance Ltd, Seefeldstrasse 233, 8008 Zurich, a manager of collective investments authorised and supervised by the Swiss Financial Market Supervisory Authority FINMA, Laupenstrasse 27, CH-3003 Bern.

Sources:

[1] International Renewable Energy Agency (2023) – Renewable Power Generation Costs in 2022 (irena.org)

[2] B. Buchner, B. Naran, R. Padmanabhi, S. Stout, C. Strinati, D. Wignarajah, G. Miao, J. Connolly and N. Marini (2023)- Global Landscape of Climate Finance 2023 – CPI (climatepolicyinitiative.org)

[3] Least Developed Countries (LDCs) – Least Developed Countries (LDCs) | Department of Economic and Social Affairs

[4] Emerging and Developing Economies (EMDEs) – Investment in emerging economies is key to energy transition. | World Economic Forum (weforum.org)

[5] Hannah Ritchie and Max Roser (2020) – “CO₂ emissions”- CO₂ emissions – Our World in Data

[6] Population Trend (1980-2029) – World Economic Outlook (April 2024) – Population (imf.org)

[7] A. Stanley (2023) – African Century (imf.org)

[8] S. Sanyal (2024) – India set to be world’s third largest economy in 2027: finance ministry (cnbc.com)

[9] Hannah Ritchie and Pablo Rosado (2020) – “Electricity Mix”- Electricity Mix – Our World in Data

[10] International Energy Agency (2020) – Electricity supply mix by region, 2020 – Charts – Data & Statistics – IEA

[11] World Economic Forum 2023 – wef_global_risks_report_2023.pdf (weforum.org)

[12] World Risk Report 2023 – WRR_2023_english_online161023.pdf (weltrisikobericht.de)

[13] World Bank definition of the Blue Economy: Sustainable use of ocean resources for economic growth, improved livelihoods and jobs, and ocean ecosystem health.

[14] Visualizing the Human Impact on the Ocean Economy (visualcapitalist.com)

[15] G. Kappen, E. Kastner, T. Kurth, J. Puetz, A. Reinhardt and J. Soininen, Boston Consulting Group (2020) – The Staggering Value of Forests—and How to Save Them | BCG

[16] IIGCC (2022) – Paris Aligned Asset Owners initiative publishes first Progress Report and initial target disclosures for a further 13 signatories (iigcc.org)

[17] B. Buchner, B. Naran, R. Padmanabhi, S. Stout, C. Strinati, D. Wignarajah, G. Miao, J. Connolly and N. Marini (2023)- Global Landscape of Climate Finance 2023 – CPI (climatepolicyinitiative.org)

Copyright © 2024, BlueOrchard Finance Ltd. All rights reserved.