The Covid-19 pandemic threatens to undo significant gains in poverty reduction

The last two decades have witnessed significant alleviation in global poverty with the share of people in extreme poverty falling significantly, from 27.8% in 2000 to 9.3% in 2017.(1) Microfinance has been one of the key pillars driving this change by helping improve access to financial services and providing springboards for people to improve their livelihoods.(2) In the last decade, 1.2 billion previously unbanked adults were able to access formal financial services.(3) BlueOrchard’s portfolio companies have contributed to this inclusion, growing assets approx. 2.5x faster than listed financial institutions emerging markets since 2010.(4)

However, 1.7 billion adults, a large part of them in emerging markets, still had no access to formal financial services as of 2018.(5) The Covid-19 pandemic worsened the situation. According to the World Bank, 400 million people may fall back into poverty as a result of the Covid-19 crisis.(6) Microfinance plays a significant role in helping low-to-middle income people rebuild their lives and livelihoods after the pandemic disruption.

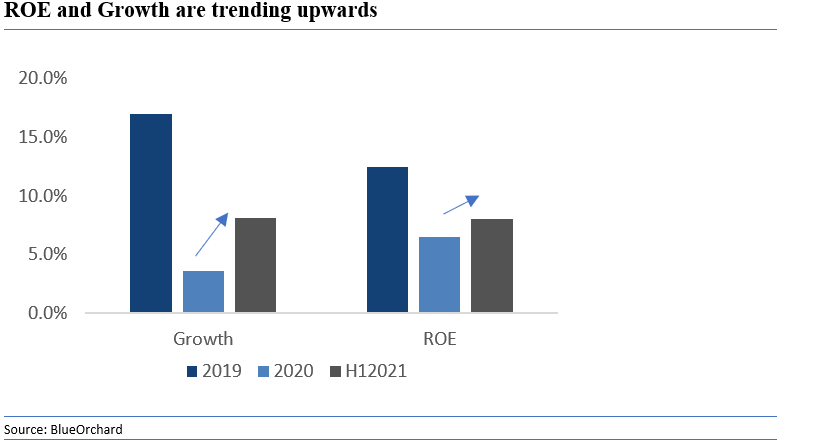

BlueOrchard data indicate that risks are easing, and growth and RoE are rising

Analysis of 187 financial services companies from 56 countries in BlueOrchard’s portfolio show clear signs of improving growth and return on equity (RoE).(7) As we adapt to the realities of this new normal over the next few years, we have experiential cause to believe these trends will continue, providing investors with a unique opportunity to generate strong returns while making a demonstrable impact.

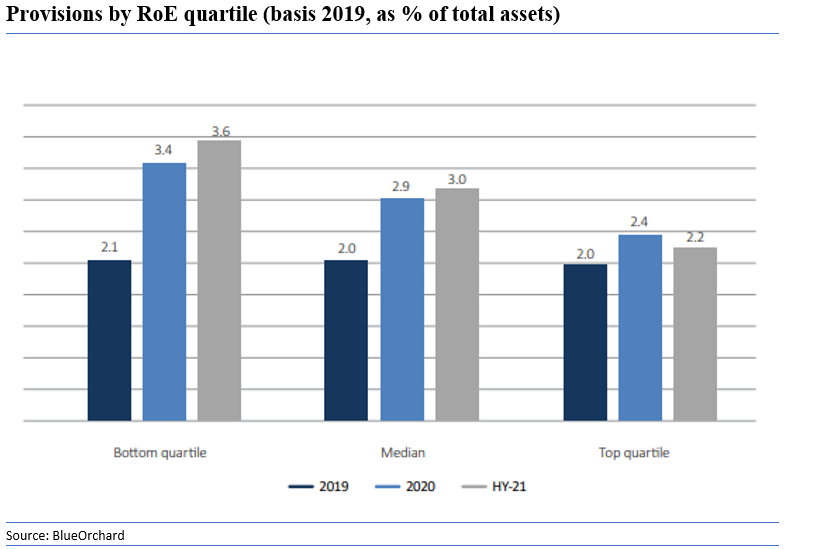

Data from BlueOrchard’s portfolio also show that the risks related to the pandemic have eased. Provisions as a percentage of total assets have stabilised for most companies, with those in the top-quartile even showing improvement. However, the pandemic has clearly impacted the balance sheets of most companies and this scenario lays the groundwork for equity fundraising in the near term.

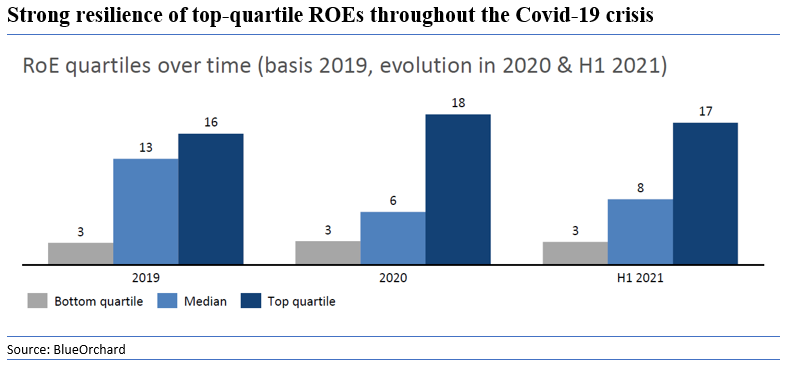

Companies that weathered the pandemic well are best placed to drive growth

The companies that have weathered the effects of the pandemic well are in a better position to achieve significant growth over the next few years as their are likely to struggle to raise growth capital. Looking across BlueOrchard’s portfolio, the top quartile companies have consistently delivered strong RoE despite the pandemic. We believe that companies of this sort are best positioned to raise equity capital and, in turn, will be best placed to drive growth in keeping with future demand.

Based on our analysis, we believe the coming years present a unique opportunity for investments in financial inclusion as pandemic-related risks subside, the industry consolidates, and stronger companies prepare for unprecedented demand growth.

Please refer to our recently released BlueOrchard Academy White Paper – Impact Private Equity – Fostering Financial Inclusion in Emerging Markets – for more insights on the opportunity in financial inclusion.

Notes:

(1) World Bank – https://data.worldbank.org/indicator/SI.POV.DDAY?end=2019&start=1967&view=chart.

(2) Taofeek Aremu Kasali , Siti Aznor Ahmad & Hock Eam Lim, The Role of Microfinance in Poverty Alleviation: Empirical Evidence from South-West Nigeria, Asian Social Science; Vol. 11, No. 21; 2015; Dejene Adugna Chomen, The role of microfinance institutions on poverty reduction in Ethiopia: the case of Oromia Credit and Saving Share Company at Welmera district, The role of microfinance institutions on poverty reduction in Ethiopia: the case of Oromia Credit and Saving Share Company at Welmera district, Future Business Journal volume 7, Article number: 44 (2021); Sayed Samer, Izaidin Majid, Syaiful Rizal, M. R. Muhamad, Sarah-Halim, Nlizwa Rashid, The Impact of Microfinance on Poverty Reduction: Empirical Evidence from Malaysian Perspective, Procedia – Social and Behavioral Sciences 195 ( 2015 ) 721 – 728; Stylianou Tasos, Muhammad Ijaz Amjad, Masood Sarwar Awan, Muhammad Waqas, Poverty Alleviation and Microfinance for the Economy of Pakistan: A Case Study of Khushhali Bank in Sargodha, Economies 2020, 8(3), 63.

(3) World Bank, On fintech and financial inclusion (worldbank.org), October 2021.

(4) BlueOrchard Academy White Paper – Impact Private Equity – Fostering Financial Inclusion in Emerging Markets, February 2022.

(5) World Bank – https://www.worldbank.org/en/topic/financialinclusion/overview#1.

(6) World Bank, June 2021.

(7) 65 companies in Asia, 21 in Africa & Middle East, 33 in Cacusus & Europe and 68 in Central & South America.

– ends –

For further information, please contact:

Tahmina Theis

+41 44 441 55 50

tahmina.theis@blueorchard.com

Disclaimer

The information in this publication was produced by BlueOrchard Finance Ltd (“BOF”) to the best of its present knowledge and belief. However, all data and financial information provided is on an unaudited and “as is” basis. The opinions expressed in this publication are those of BOF and its employees and are subject to change at any time without notice. BOF provides no guarantee with regard to the accuracy and completeness of the content in this publication. BOF does not in any way ascertain that the statements concerning future developments will be correct. BOF does not under any circumstance accept liability for any losses or damages which may arise from making use of, or relying upon any information, content or opinion provided by BOF in this publication. This publication is provided for marketing reasons and is not to be seen as investment research. As such it is not prepared pursuant legal requirements established for the promotion of independent investment research nor subject to any prohibition on dealing ahead of the distribution of investment research. This publication may contain information, references or links to other publications and websites from external sources. BOF has not reviewed such other publications and websites. BOF in particular does neither guarantee that such information is complete, accurate and up-to-date nor is BOF responsible in any way in relation to the content of such publications and websites. The information in this publication is the sole property of BOF unless otherwise noted, and may not be reproduced in full or in part without the express prior written consent of BOF. All investments involve risk. We note specifically that past performance is not an indication of future results. Emerging markets impact investments involve a unique and substantial level of risk that is critical to understand before engaging in any prospective relationship with BOF and its various managed funds. Investments in emerging markets, particularly those involving foreign currencies, may present significant additional risk and in all cases the risks implicated in this disclaimer include the risk of loss of invested capital. To understand specific risks of an investment, please refer to the currently valid legal investment documentation. The materials provided in this publication are for informational purposes only and nothing in this publication can be construed as constituting any offer to purchase any product, or a recommendation/solicitation or other inducement to buy or sell any financial instrument of any kind and shall not under any circumstances be construed as absolving any reader of this publication of his/her responsibility for making an independent evaluation of the risks and potential rewards of any financial transaction. We note in particular that none of the investment products referred to in this publication constitute securities registered under the Securities Act of 1933 (of the United States of America) and BOF and its managed/advised funds are materially limited in their capacity to sell any financial products of any kind in the United States. No investment product referenced in this publication may be publicly offered for sale in the United States and nothing in this publication shall be construed under any circumstances as a solicitation of a US Person (as defined in applicable law/regulation) to purchase any BOF investment product. The information provided in this publication is intended for review and receipt only by those persons who are qualified (in accordance with applicable legal/regulatory definitions) in their respective place of residence and/or business to view it, and the information is not intended under any circumstances to be provided to any person who is not legally eligible to receive it. Any recipient of information from this publication who wishes to engage with BOF in furtherance of any transaction or any relationship whatsoever must consult his/her own tax, legal and investment professionals to determine whether such relationship and/or transaction is suitable. By no means is the information provided in this document aimed at persons who are residents of any country where the product mentioned herein is not registered or approved for sale or marketing or in which dissemination of such information is not permitted. Persons who are not qualified to obtain such publication are kindly requested to discard it or return it to the sender. BOF disclaims all liability for any direct or indirect damages and/or costs that may arise from the use of (whether such use is proper or improper), or access to, this publication (or the inability to access this publication). BOF has outsourced the provision of IT services (operation of data centers, data storage, etc.) to Schroders group companies in Switzerland and abroad. A sub-delegation to third parties including cloud-computing service providers is possible. The regulatory bodies and the audit company took notice of the outsourcing and the data protection and regulatory requirements are observed.

Copyright © 2022, BlueOrchard Finance Ltd. All rights reserved.