Solar investments in Southeast Asia are booming

Owing to its geographic location, annual global horizontal irradiation (GHI) levels – a crucial measure of the solar energy hitting a solar panel – is remarkably high in many parts of Southeast Asia. Indeed, total solar power potential is estimated at 41 terawatt-hours (TWh). That’s equivalent to about 14% percent of all electric energy used by the UK in 2020, according to Statista. (1)

Further, it’s grown blisteringly fast, and demand is rising. Solar power capacity in Southeast Asia more than doubled between 2019 and 2020, increasing from 10.4 GW to 22.9 GW, and more is needed. (2) As a key part of decarbonization efforts, demand for renewable power is growing rapidly, particularly in the important manufacturing industry. Manufacturing alone will require 27 GW of new solar installations, across the region, over the next five years. (3)

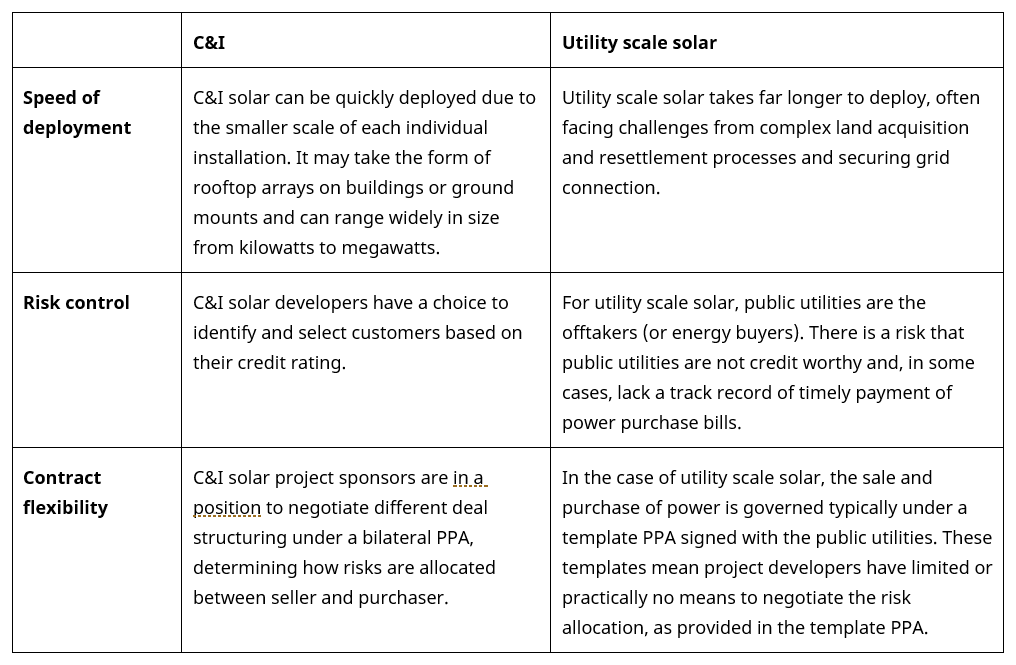

Even so, some types of solar power are beset with more hurdles to success than others, and investors need to know the difference.

As the adoption of renewable energy accelerates in the region, commercial and industrial (C&I) solar appears to us to be the best positioned, versus utility scale solar projects. We explain what C&I is, as well as why it differs in terms of technology improvements, economics and financing, and deal structuring options.

Industry characteristics of solar power: utility-scale solar vs C&I solar

Much of the added solar power capacity in Southeast Asia has come from utility-scale, grid-connected solar power projects. However, these large utility-scale solar projects face several difficulties. Securing land rights is one, with the projects often competing with agricultural land, impacting food security.

Project financing in these markets is also challenging. Power purchase agreements, or “PPAs”, are the contracts exchanged between a power supplier and a buyer or user of the power. While long term PPAs with a public utility can offer renewable energy investors greater certainty of revenue than if reliant on fluctuating power prices in the merchant power market, they have their downsides.

In short, so-called “template PPAs” with public utilities can carry lopsided risk. Investors and financiers can take on more uncertainty. For example, if there is a force-majeure and the solar power plant is not operating, the loss is borne entirely by asset owner, and no relief is given by the government-owned utility. Many state-owned utilities in the region are also not creditworthy. Counterparty risk in long-term investments is crucial, so ensuring that the buyer of power is “bankable” – i.e. can meet its financial obligations for the full term of 10-20 years – is crucial.

The primary defining characteristic of utility-scale solar projects is that they are tied to national grids and sell the power they generate directly into the electricity grid. Utility-scale solar are often described as being “in front of the meter”. On the other hand, distributed generation systems such as C&I solar, are described as “behind the meter”. A C&I system is paired with the energy load of a customer and supplies that customer directly without the grid in between.

The economics of utility-scale solar projects are mainly derived from a tariff, often backed by a government through what’s called a feed-in-tariff (FIT)(4). They may also use a tariff based on an auction process or other incentives.

C&I solar – control, speed, simplicity

Unlike utility-scale solar, C&I solar developers can provide access to the solar energy market through different business models. We outline a couple of these below.

CAPEX model or outright purchase – Under this business model customers own a solar system utilising their own capital, and directly benefit from the energy saving from the solar energy generated.

Opex model – Under this model there are broadly two variations:

- Solar leasing provides C&I customers the use of the solar energy system in exchange for an agreed monthly fee or with an agreed solar tariff. This is a lower electricity tariff than the grid tariff, depending on the leasing agreement offered by the third-party. Solar leasing customer examples could include shopping malls, universities, medical centres or hotels.

This model gives the customer better flexibility than a capex model, as there is little to zero upfront cost to install a solar system at their building. Lease agreements are usually around 15 years. At the end of lease agreement period, the ownership of the solar system will be transferred back to the lessor. In some cases, lessees (the C&I customer) may have to purchase the solar system at the end of the agreed time frame at a subsidized rate, renew the lease or have the system removed.

- Corporate renewable PPA refers to a contract between a corporate buyer and a renewable power producer to purchase electricity at a pre-agreed price and duration. The solar power plant – located offsite – utilises existing transmission infrastructure of public utilities. This is arranged under an “open access” system by paying a fee or “wheeling charge” to the utilities for using their assets.

The corporate PPA market for renewable procurement is largely dominated by firms that have set ambitious decarbonisation targets in the region. These are large energy users, particularly RE 100 companies who have signed PPAs with offsite projects for their ambitious 100 percent renewable targets to be feasible. RE100 is a group of influential companies globally that have committed to 100 percent renewable electricity use by 2050.

The economics of C&I solar are derived from (i) energy volume savings i.e. displacement of grid power with solar power; (ii) peak “shavings” by way of eliminating short-term demand spikes, and so avoiding demand charges where the customer pays demand charges for “peak demand”; and (iii) where the regulatory environment allows net metering, exporting surplus power to the grid. (5)

Fact check: Why C&I solar edges out large utility-scale solar

C&I solar: compelling growth and resilience through uncertainty

The Covid-19 pandemic caused global supply chain constraints, pushing up costs and posing challenges to the power sector as a whole. Solar power was no exception. Among the biggest headwinds for solar has been a tripling of steel prices, a key component in the solar panel mounting systems, and polysilicon, the raw material used in solar panels.

We expect the hikes in polysilicon prices are likely to start easing towards the end of 2022 and that will be accompanied by further improvements in solar cell efficiency. Together, these two factors, along with an expected easing of freight and shipping delays in 2023, could lead to overall solar price declines by 2024.

An increase of solar panel production and deployment holds tremendous potential as corporate policy and environmental, social, and governance (ESG) concerns drive higher demand for renewable energy sources. IHS Markit estimates that solar module production could be raised by an additional 25 percent over the next 12 months. (6)

However, C&I projects were also comparatively resilient through the pandemic and are structurally less vulnerable to cyclicality and cost inputs. A prominent example is Vietnam where there was an ongoing FIT that was very attractive, and the industry rushed to add a whopping 11 GW rooftop PVs during the pandemic in 2020, according to data released by IRENA. (7)

Shipping and materials costs for C&I solar projects account for a lower percentage of the overall project cost than that of other energy projects, including utility solar projects. If shipping and equipment costs creep up, it’s less likely to financially ‘make-or-break’ a C&I project when compared to other energy projects.

Further, while investment in large energy projects can face headwinds during periods of major disruption, opportunities for “bite-sized” renewable energy developments – like lower-megawatt C&I solar – can proliferate. Finally, as industries strive to bring down cost of production due to rising inflation, and soaring energy costs, C&I solar provides a pathway for industries to save on the cost of electricity consumption.

A clean and reliable energy future

It is clear that as the economy in southeast Asia reopens, we should see a recovery in solar demand. The question of how quickly, and which energy sources will generate the quickest response, remains to be seen. Even so, C&I solar is emerging as a resilient option for the build out of a clean and reliable energy future.

EXTENDED TOUGHT PIECE

For more in-depth information on this topic, please read our extended thought piece “Southeast Asia witnesses solar boom in grid connected utility scale solar – what is next?” here.

Notes:

(1) The analysis by National Renewable Energy Laboratory (NREL), operated by Alliance for Sustainable Energy, LLC, for the U.S. Department of Energy (DOE)

(2) Data released by the International Renewable Energy Agency (IRENA)

(3) IHS Markit analyst

(4) A feed-in tariff, or FiT, is a policy mechanism that compensates solar customers at a fixed rate per kilowatt hour (either on gross or net generation) and is guaranteed for a long period.

(5) Demand charges can be a significant part of a monthly utility bill for large customers with spiky load profile such as businesses, manufacturing and industrial operations, educational institutions and faith-based organizations.

(6) “Executive Briefings: Oil and Gas Global Energy: The crunch of 2021—a crisis of surplus capacity” -IHS report

(7) https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2021/Apr/IRENA_RE_Capacity_Statistics_2021.pdf

– ends –

For further information, please contact:

Tahmina Theis

+41 44 441 55 50

tahmina.theis@blueorchard.com

Disclaimer

The information in this publication was produced by BlueOrchard Finance Ltd (“BOF”) to the best of its present knowledge and belief. However, all data and financial information provided is on an unaudited and “as is” basis. The opinions expressed in this publication are those of BOF and its employees and are subject to change at any time without notice. BOF provides no guarantee with regard to the accuracy and completeness of the content in this publication. BOF does not in any way ascertain that the statements concerning future developments will be correct. BOF does not under any circumstance accept liability for any losses or damages which may arise from making use of, or relying upon any information, content or opinion provided by BOF in this publication. This publication is provided for marketing reasons and is not to be seen as investment research. As such it is not prepared pursuant legal requirements established for the promotion of independent investment research nor subject to any prohibition on dealing ahead of the distribution of investment research. This publication may contain information, references or links to other publications and websites from external sources. BOF has not reviewed such other publications and websites. BOF in particular does neither guarantee that such information is complete, accurate and up-to-date nor is BOF responsible in any way in relation to the content of such publications and websites. The information in this publication is the sole property of BOF unless otherwise noted, and may not be reproduced in full or in part without the express prior written consent of BOF. All investments involve risk. We note specifically that past performance is not an indication of future results. Emerging markets impact investments involve a unique and substantial level of risk that is critical to understand before engaging in any prospective relationship with BOF and its various managed funds. Investments in emerging markets, particularly those involving foreign currencies, may present significant additional risk and in all cases the risks implicated in this disclaimer include the risk of loss of invested capital. To understand specific risks of an investment, please refer to the currently valid legal investment documentation. The materials provided in this publication are for informational purposes only and nothing in this publication can be construed as constituting any offer to purchase any product, or a recommendation/solicitation or other inducement to buy or sell any financial instrument of any kind and shall not under any circumstances be construed as absolving any reader of this publication of his/her responsibility for making an independent evaluation of the risks and potential rewards of any financial transaction. We note in particular that none of the investment products referred to in this publication constitute securities registered under the Securities Act of 1933 (of the United States of America) and BOF and its managed/advised funds are materially limited in their capacity to sell any financial products of any kind in the United States. No investment product referenced in this publication may be publicly offered for sale in the United States and nothing in this publication shall be construed under any circumstances as a solicitation of a US Person (as defined in applicable law/regulation) to purchase any BOF investment product. The information provided in this publication is intended for review and receipt only by those persons who are qualified (in accordance with applicable legal/regulatory definitions) in their respective place of residence and/or business to view it, and the information is not intended under any circumstances to be provided to any person who is not legally eligible to receive it. Any recipient of information from this publication who wishes to engage with BOF in furtherance of any transaction or any relationship whatsoever must consult his/her own tax, legal and investment professionals to determine whether such relationship and/or transaction is suitable. By no means is the information provided in this document aimed at persons who are residents of any country where the product mentioned herein is not registered or approved for sale or marketing or in which dissemination of such information is not permitted. Persons who are not qualified to obtain such publication are kindly requested to discard it or return it to the sender. BOF disclaims all liability for any direct or indirect damages and/or costs that may arise from the use of (whether such use is proper or improper), or access to, this publication (or the inability to access this publication). BOF has outsourced the provision of IT services (operation of data centers, data storage, etc.) to Schroders group companies in Switzerland and abroad. A sub-delegation to third parties including cloud-computing service providers is possible. The regulatory bodies and the audit company took notice of the outsourcing and the data protection and regulatory requirements are observed.

Copyright © 2022, BlueOrchard Finance Ltd. All rights reserved.